The Discount rate, sometimes called the 'Owner's Cost of Money' is used to determine the 'Time value of Money'. This is the discount rate used to determine the value today of a future sum.

The IES recommends using a rate that reflects the business owners's average cost of using other peoples money, or the owners cost of capital (borrowing). If you have enough information about the owners finances you could calculate the 'weighted average cost of capital'. However, since this information is generally not available, the IES also allows you to use more commonly available information like the 'prime rate' currently charged by major lenders. Typical values for Opportunity rate range between 3-12%. If you enter an Opportunity rate of 0% future cash flows will not be discounted (not recommended).

| The effect of interest rate is best illustrated in the 'Yearly Cost Summary' section. You can find this section below the annual results section. The center column shows the future value, costs calculated without including the time value of money. The right hand column shows the present values of each year, using the opportunity rate to discount the future values to present values. You can see that present values of constant sums decrease more and more over time. |

|

| If you have escalating electricity costs, you will see that your future costs are in fact increasing, however, the present values will still decrease overtime albeit slower than they would if you didn't have increasing electricity costs. |

|

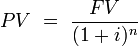

| This formula used to find the present value (PV) of a future value (FV) that occurs in (n) years at a (i) discount rate. |

|

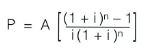

| This formula is used to extrapolate the present value (P) of the total life cycle cost for a given annual cost (A) that happens for (n) years at a (i) discount rate |

|